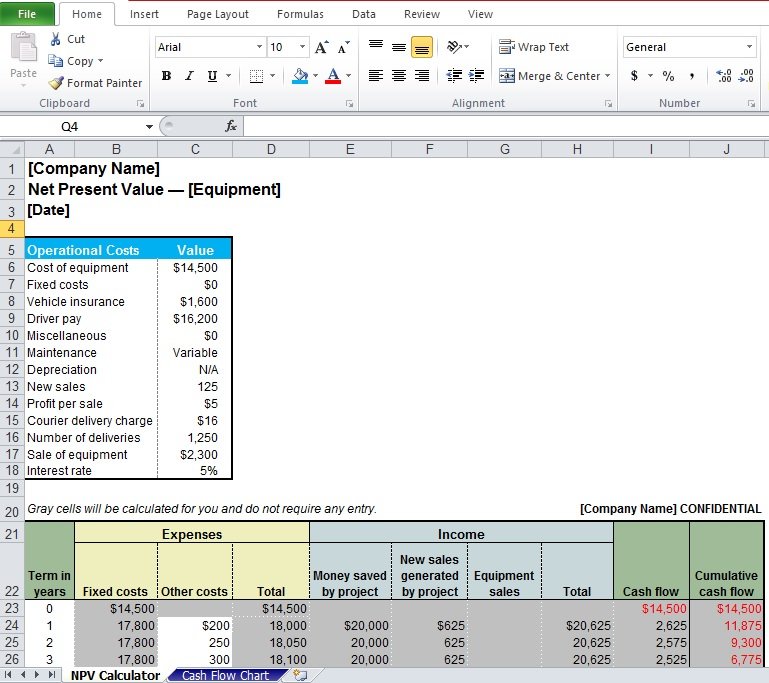

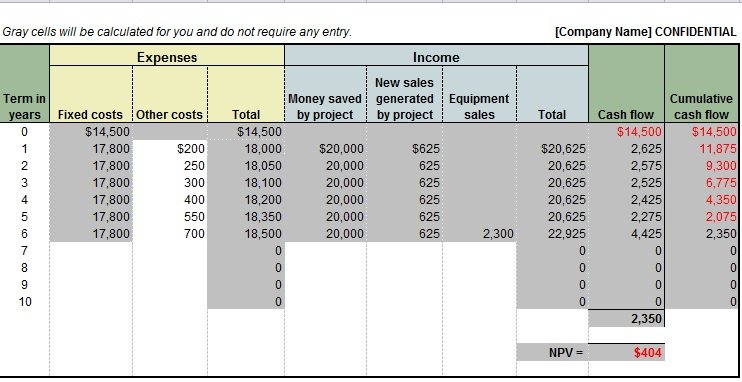

Companies can use the professional net present value calculator excel template to help easily decide whether the investment will add value in a long time. It also helps to compare with different investment options and to easily decide whether to introduce the new product. In addition to explaining how to easily calculate NPV and IRR. You can easily download it to help you see how to set up your own financial analysis spreadsheet.

It is a common financial calculation which used to easily determine the profitability of the investment and project. It can also be easily calculated by hand, although it can maybe very easier to use it to avoid errors. It also has a sample Excel net present value model and a built-in calculator. You can easily use this calculator in the worksheet to do your own net present value calculations. You may also like the credit card payoff excel template.

You can click on the individual cells within the NPV Excel file to easily see the formulas which are used to calculate the Excel net present value. The row is titled ‘Project NPV’ displays your net present value for the specified investment. The first two examples Project A and Project B, have the positive net present values. The Excel net present value for Project C is a negative value highlighted in the red. You will also notice that the calculator has calculated a negative difference and the percentage. If you need to include the more projected cash to flows. You can easily edit the NPV by adding more rows and changing the number of the years for the investment. You should also check the employee pay stub excel template.

Table of Contents

Net Present Value Calculator Excel Template

How To Use Net Present Value Calculator Excel Template?

This calculator is very simple and easy to use. With the help of the net present value function, we can easily evaluate whether the cash flow that’s regular and irregular is worth the initial investment, after taking the time and the initial cost into the account. Both of these are the valuable ways to help you to make your best financial decisions which are based on facts, In fund, it is essentially insufficient to contrast the aggregate sum of cash with gauge and assess income. It is likewise profoundly critical to consider a period interim of the income.

As cash may lose its incentive after some time, a similar timeframe ought to be taken to analyze certain measure of cash. For this situation, Value is utilized as an underlying time interim of the income. You may also see the debt snowball calculator template.

The less demanding approach to effectively ascertain NPV in Excel is to bar the underlying money surge from your NPV recipe. This will give you the present estimation of just the future money streams. At that point, you can basically net our underlying money cost from this present estimation of future money streams count. Since the net present value calculator excel template esteem is just esteem short cost, this approach is considerably more instinctive to the vast majority.

This straightforward present esteem estimation demonstrates to you that the higher the rate of giving back, the lower the sum required today to subsidize the future cost. This is a test in retirement arranging; keeping in mind the end goal to accomplish a higher rate of return you should commonly pick a more hazardous portfolio, which implies the higher return is conceivable, yet not certain.not just the instinct.