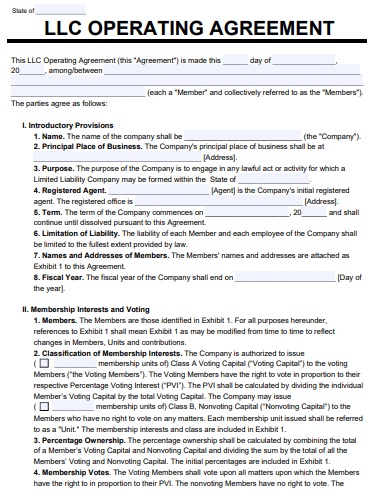

According to state of Iowa, the business owners have to file an Iowa LLC operating agreement template that outlines the fundamental operational structure of a company. The operating agreement carries the following information;

- How the owners intend to run the business in the future

- The operational procedures

- Structure of internal affairs

- The roles of every member

- The model for creating critical business-related decisions

Table of Contents

The advantages of an operating agreement:

Let us discuss below the advantages of this agreement;

State’s recommendation

Under section 489.110, the state recommended every LLC business to have an operating agreement to serve as a guidebook in its operations.

Protects the status of business

The document upholds your limited liability status in the eyes of the law along with adding to the wholesome credibility of your business. In the case of liability issues, by setting a boundary that recognizes you as a member of the legal entity that is the business, the document protects you.

Eases the tension

Cases of conflict become rare by having everything from policies to each member’s responsibility put down on paper as well as they are easily manageable when they arise.

Solidifies verbal agreements

Verbal agreements are week in nature. It is hard to suffice written agreements as it is generally what one person says against what their counterpart says. You solidify your agreement by documenting your LLC agreement and can walk into the actual business by having much more confidence.

Credibility of business

Your business is legitimized by this document and it presents you as an organized entrepreneur. Third parties who may be interested in engaging with your business will be convinced that your business is conducted in an organized way upon proving the existence of an operating agreement.

Stops interference by the state

If you are operating an LLC without an operating agreement, this automatically means that you are at the mercy of the state’s laws. While, you can set your own rules and policies for major events like a change of ownership by filing an Iowa operating agreement. For instance, a member suddenly dies without filing a will. According to state laws, the deceased’s equity goes to their family.

How to form an LLC in Iowa?

Here are the steps to follow to form an LLC in the Iowa state;

Find a registered statutory agent

A business or an individual could be your preferred agent as well as they are licensed to carry out their work in the state of Iowa. Their work is to get the company’s important documents such as the annual state filings.

Preparing registration documents

The state of Iowa needs locally formed LLCs to independently create their document. On the other hand, to start operating in Iowa, existing LLCs can download the Certificate of Authority as required by state law.

Meet fee requirements

For domestic LLC, Iowa has set a fee of $50 and for foreign LLC, $100 is required that should be paid via check to the secretary of state. It is also required by the state that foreign LLC applicants have to attach existence certificate from the authorities in their first state of operation. More than 90 days from the time of the application, the certificate must not be aged. Send your application to the given address when you have prepared everything.

File the agreement

The owners have to place together an operating document that serves as a constitution to govern their relationship as business partners.

Get an Employer Identification Number

An EIN number is issued by the IRS. This number will grant permission to employ workers. On the IRS website, you can get your EIN number.

Iowa LLC Operating Agreement

Free Iowa LLC Operating Agreement Template

Conclusion:

In conclusion, an Iowa LLC operating agreement template is an internal document that facilitates organization, conflict resolution, and other constraints of operating a business. In order for your business to be recognized in a legal capacity, submit a Certificate of Organization to the secretary of state.