A monthly budget template is an effective tool that provides an overview of your monthly finances and enables you to achieve your financial goals. With this tool, you can estimate your earnings for the whole month and your spending over the month.

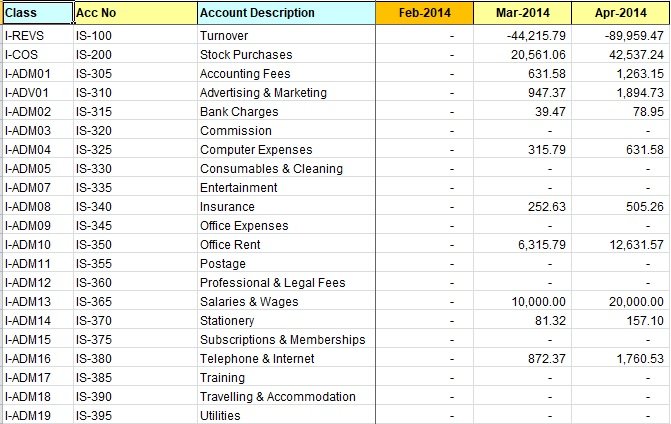

Moreover, companies can also use this document to get a clear overview of their financial health and to keep track of their incomes and expenses. It identifies where you might be overspending and helps you find ways to meet your company’s goals.

Table of Contents

What do you mean by monthly budgeting?

Monthly budgeting is a process of estimating your monthly income and spending. It enables you to list, track, and assess all your monthly income sources, expenses, and savings. Budgeting helps you save more money for your future investment needs and achieve your financial goals.

Why should you use a monthly budget template?

Here are some reasons for using a monthly budget template;

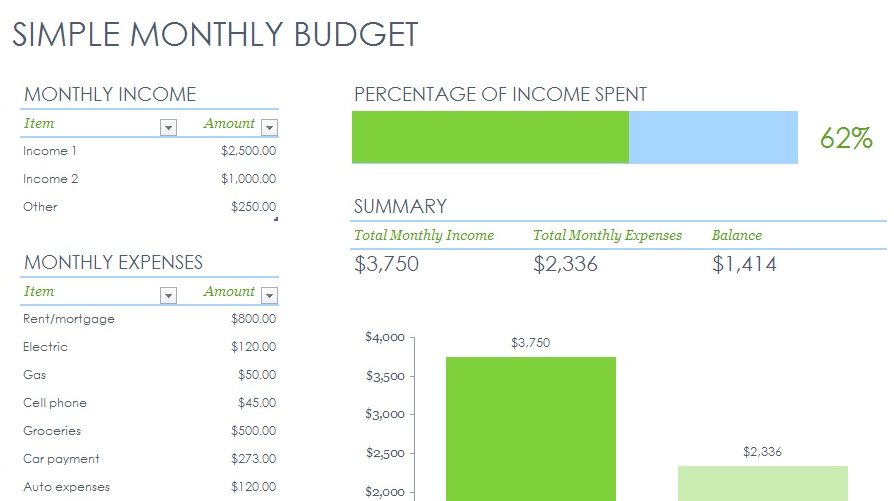

- Using a monthly budget template is a convenient way to track your income and expenses. It enables you to determine whether your budget is balanced or you need to reduce your expenses.

- This budgeting template allows you to spend within your means. Adding each section in the template identifies whether your monthly income is enough to pay for your planned expenses.

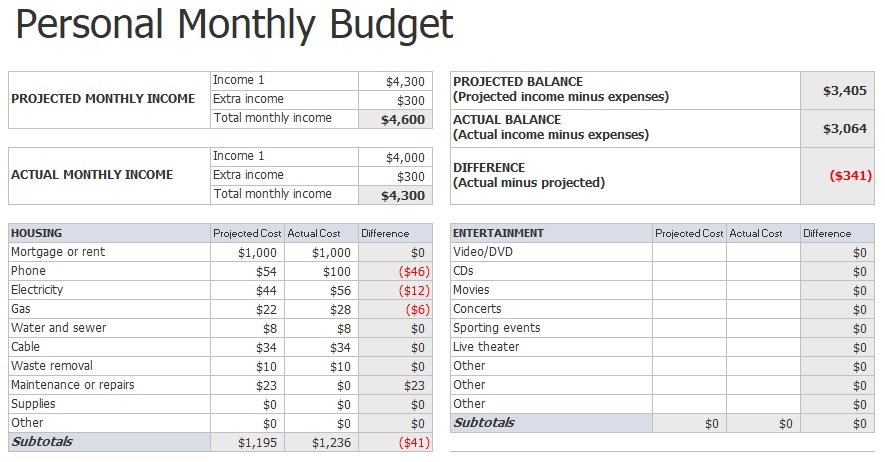

- For each category, it compares your planned expenses, savings, and income with actual numbers. With the template, you can determine areas where you need to get on track.

- At the end of every month, it calculates disposable income. This calculation enables you to identify whether you have extra money for savings or you need to reduce some expenses.

- Since the monthly budget template divides your budget into categories, you can determine where the majority of your spending happens.

Free Printable Monthly Budget Template

Free Monthly Budget Planner Template

Editable Personal Monthly Budget Template

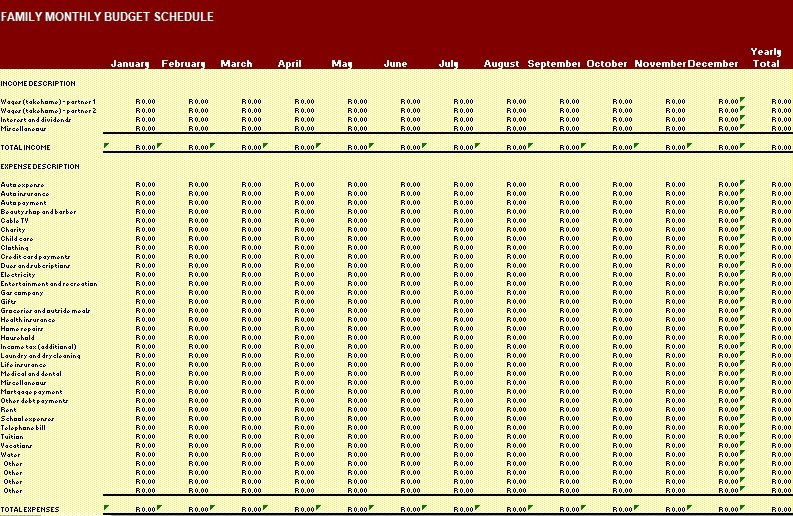

Family Monthly Budget Worksheet

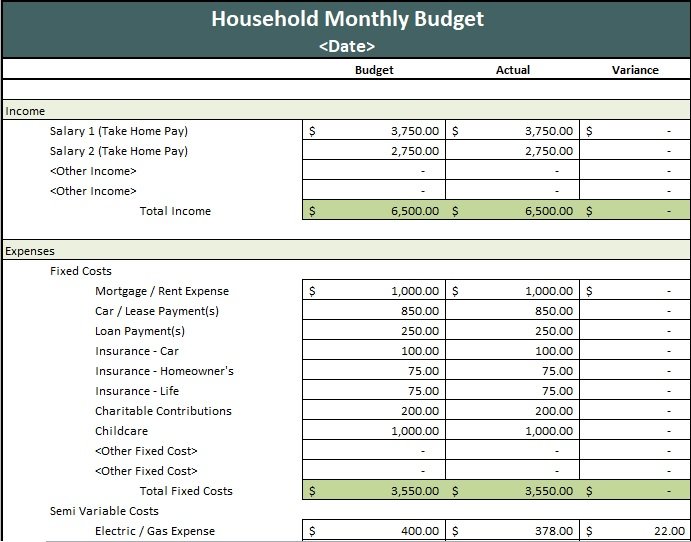

Printable Monthly Household Budget Spreadsheet

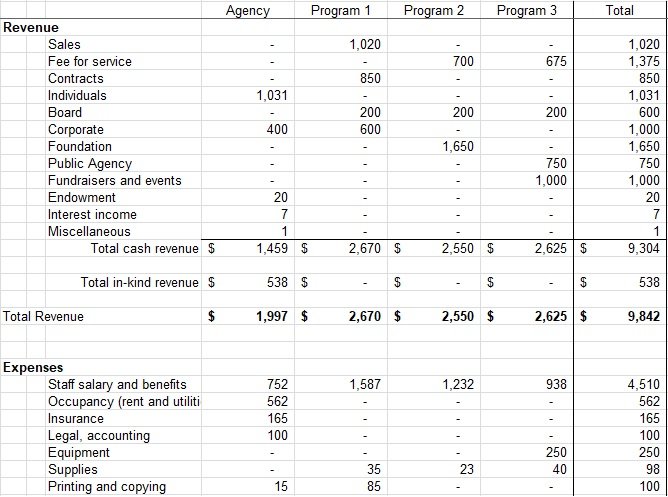

Corporate Monthly Budget Plan Template

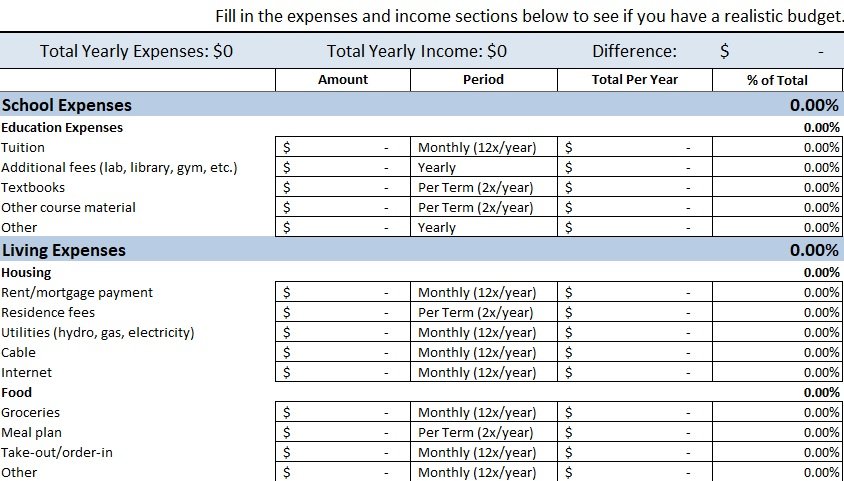

Student Monthly Budget Template

Company Monthly Budget Spreadsheet

What to include?

Your monthly budget template should include the following sections;

Income

Specify all your monthly income sources such as paychecks, contractor payments, child support, etc.

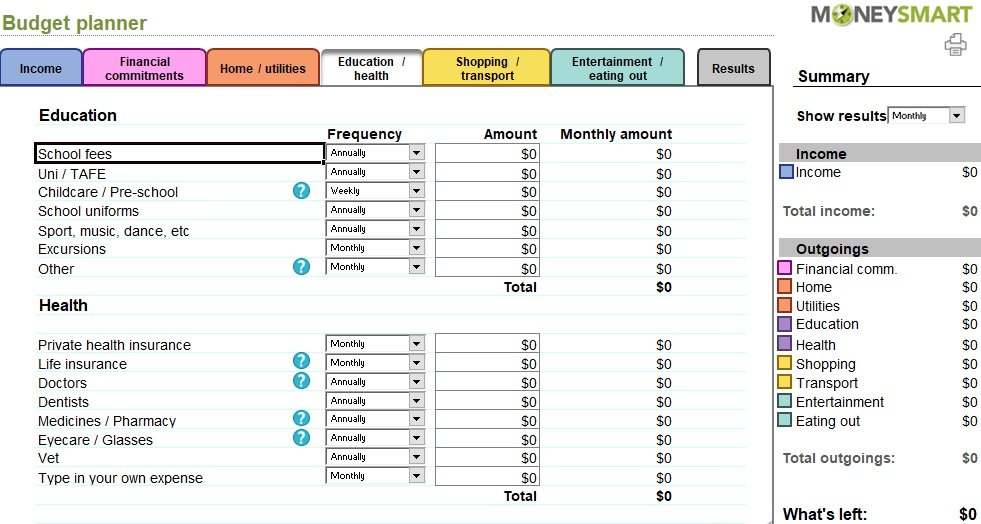

Housing and utilities

Here, you need to specify the following;

- Mortgage or rent payments

- Property tax

- Household insurance and maintenance or repairs

- Natural gas, electricity, water, cable and internet bills

- Other utilities

Transportation

Include expenses relevant to transportation such as vehicle payments, recurring costs (parking, gas, and tolls), and public transportation.

Food

This section includes monthly groceries, nights out at restaurants, and delivery orders.

Health care

Expenses relevant to health insurance should be included in this section. This may include copayments, prescription, and over-the-counter medications.

Finance

This section of your monthly budget should include expenses related to card payments and fees, student loan payments, and other fees or prepaid.

Miscellaneous

It may include expenses for entertainment like movies or concerts.

Savings

The saving section of your budget includes your monthly savings as well as retirement savings.

How to choose an effective budget template?

Consider the following pointers while choosing an effective budget template;

- It should already contain all the necessary income and expense categories so that you don’t need to spend time to customize them.

- To achieve the end goal, ensure that the calculation should be accurate.

- The formulas it contains should give proper answers.

- To provide you better budgeting picture, it should automatically calculate differences between actual and estimated values. This way, you don’t need to enter formulas and calculate them.

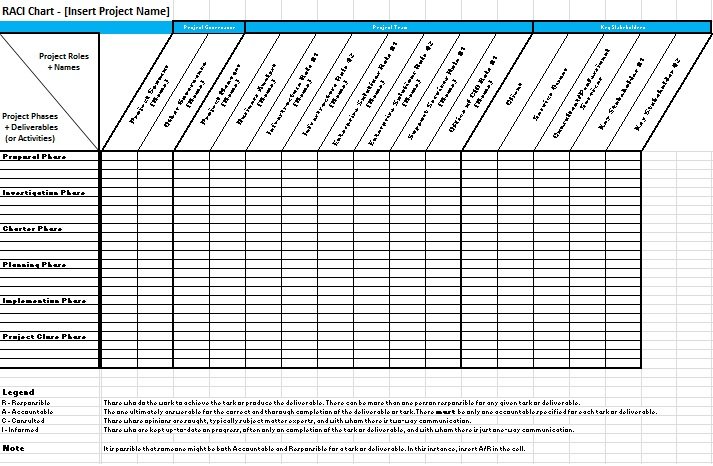

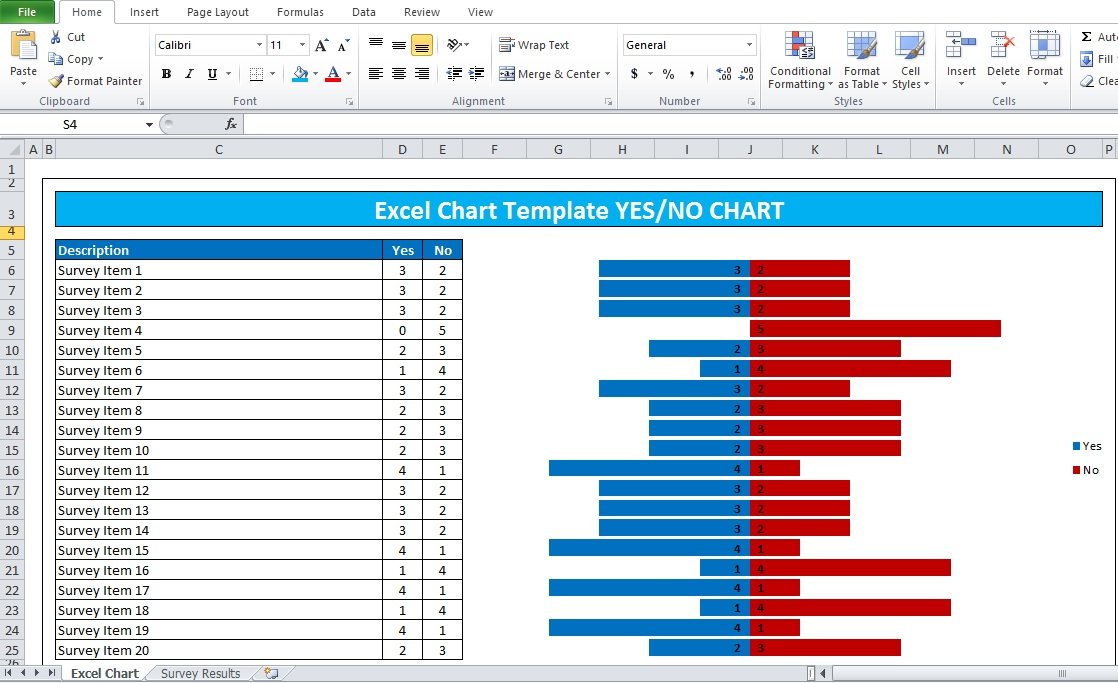

- There must be graphic visualization so that you can effectively understand the performance of your budget.

How to use a monthly budget template?

Here are the tips to follow to take more benefits from a budget template;

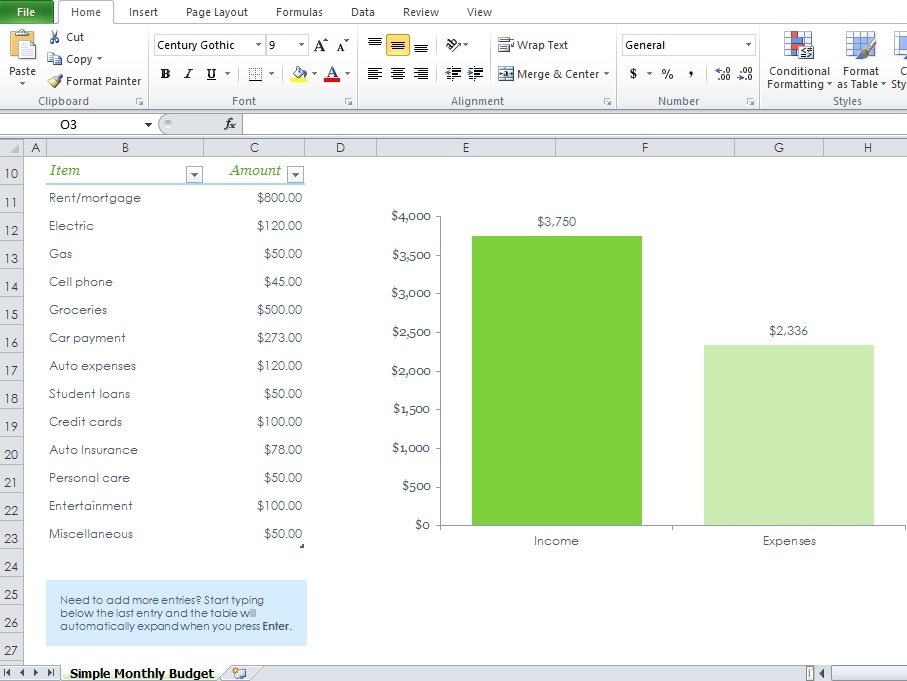

- Select the template that has pre-listed all income and expense categories so that you don’t need to write them yourself.

- By adding and deleting, customize the budget categories as per your preferences.

- You just need to enter values and don’t edit or change the formulas.

- Don’t use the same template to make multiple budgets. Instead, use a separate template for each budget.

- The template must have a different column to determine in which category you spent more or less.

- Save it on your desktop to review.

FAQ’s

These are as follows;

1- Cash Envelope system

2- Zero-based budgeting

3- 50/30/20 budgeting

4- 60% budgeting method

5- The no-budget budgeting

6- The barebone budgeting

If you want to stick with a monthly budget then consider the following tips;

1- Before going shopping, create a shopping list.

2- Unsubscribe from all online stores such as Aliexpress, Amazon, and more.

3- Limit visiting restaurants and fun activities.

4- Use low-interest credit cards instead of multiple credit cards.