A cash book template is an accounting tool used to record all the cash payments made by your company. Accountants, accounts assistants, and small business owners usually use this document. They use it to simplify the process of reconciliation.

Table of Contents

What is a cash book?

A cash book is a good way to record transactions done in your company regularly. It is the simplest form of bookkeeping also known as income and expenditure.

Moreover, the cash book is subdivided into two different journals in large companies where there are high volumes of cash transactions. The first one is known as the receipt Journal and the other is the disbursement journal. While the smaller businesses maintain all the cash transactions in a single cash book.

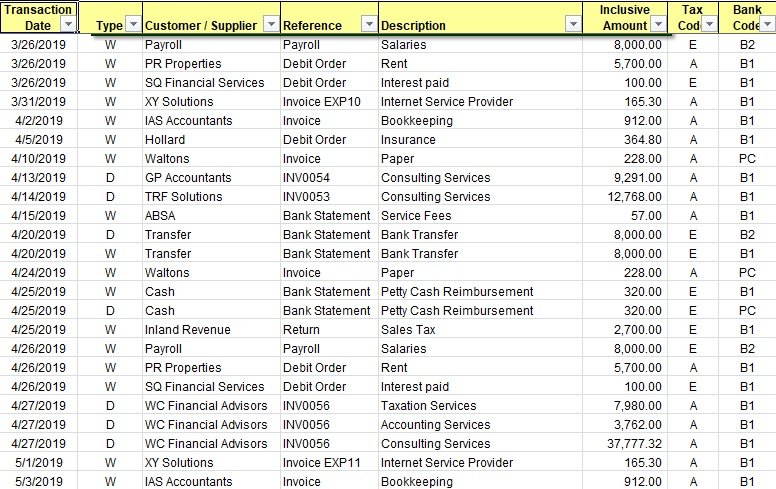

In the cash book, record all transactions in chronological order so that you can reconcile the cash balances easily when needed. The debit side of the cash book records all the receipts cash and all payments and expenses are recorded on the credit side.

What are the different types of cash books?

Here are the different types of cash books;

Single-column cash book

This type of cash book records inward and outward cash transactions of your company without any discounts or tax. It has 2 sides i.e. debit side and the credit side.

Double-column cash book

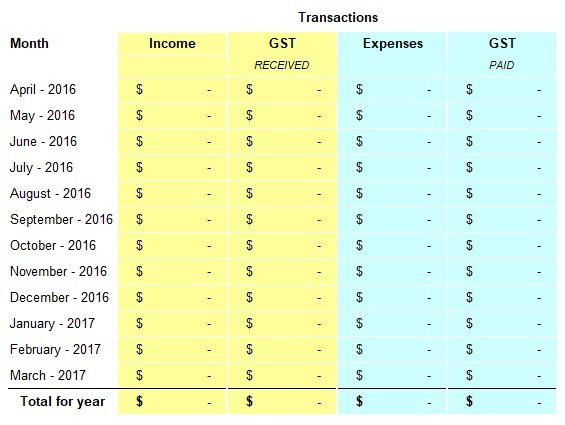

Along with a credit and debit side, it contains an extra column for discounts or tax either GST (Goods and Service Tax) or VAT (Value Added Tax).

Triple-column cash book

The triple-column cash book contains additional columns for discounts and tax. It is used by companies that have daily cash transactions including giving/taking discounts and collecting or paying taxes.

What to include in a cash book?

The cash book includes the following information;

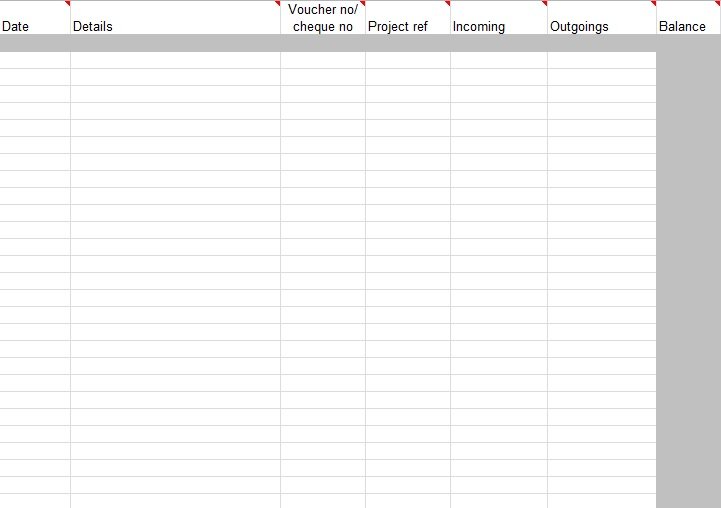

- Date of the transaction

- Receipt number

- Booking text (precise details of the transaction)

- The cash revenue or expenditure receipt

- Applied tax rate (sales tax)

- Current cash balance

- Debit balance

There are two additional fields in the header of the cash book where you provide the name of your company and record the time when the respective cash book was kept. Document all incurred income and expenses chronologically. If you are using the cash book format for Excel, the program automatically displays the current balance.

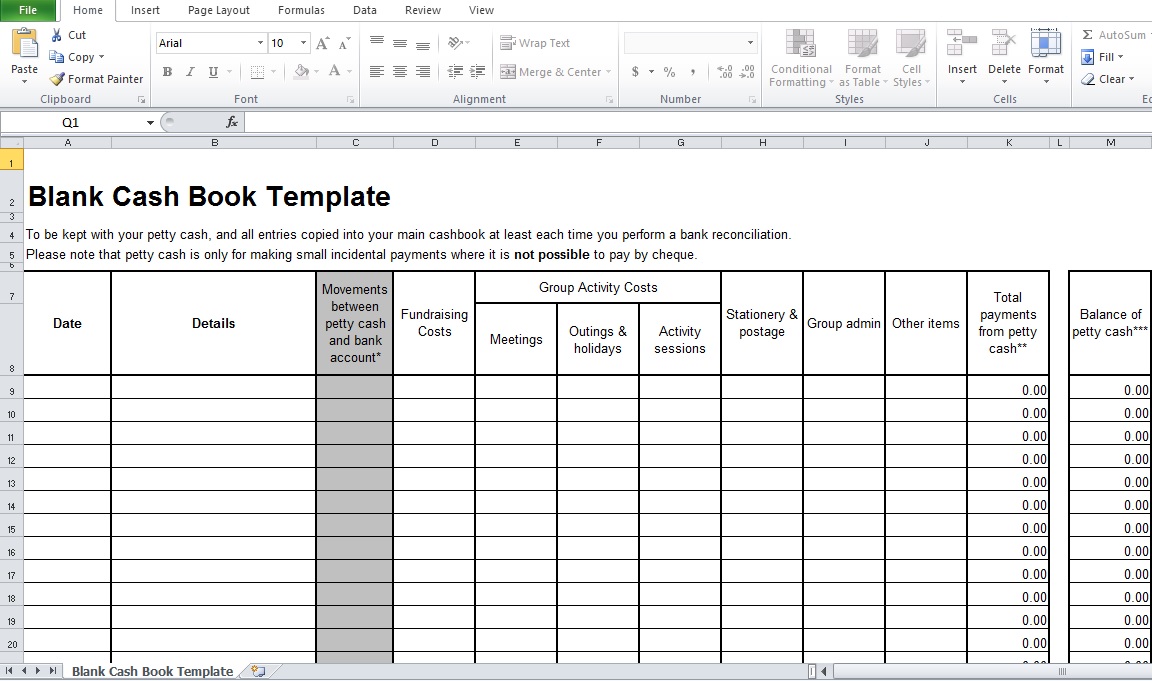

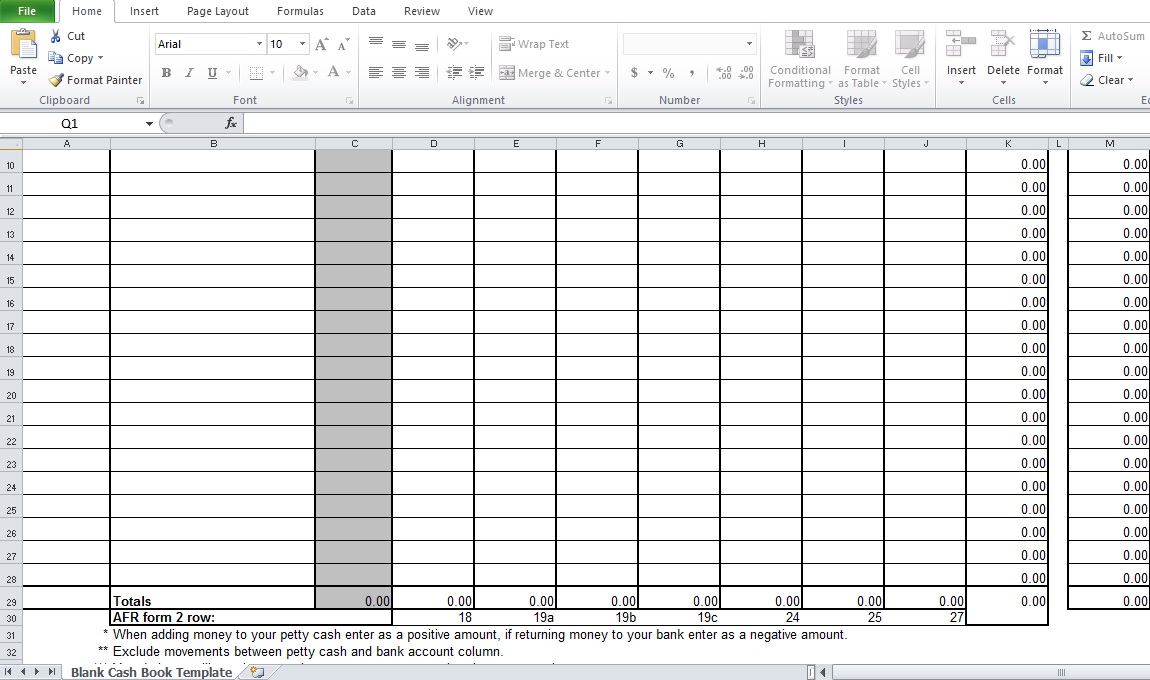

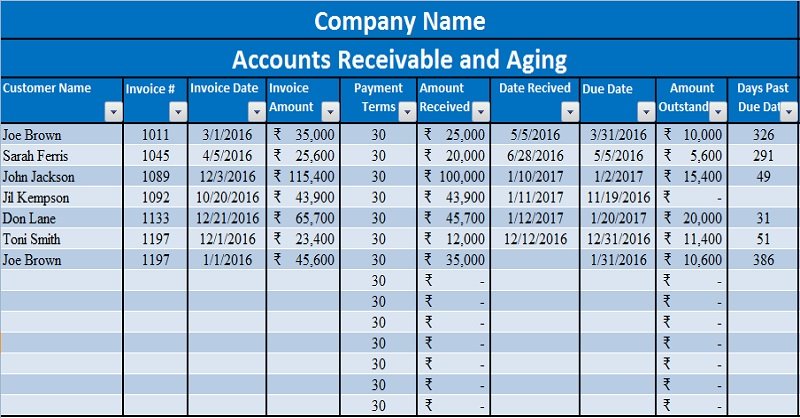

Printable Cash Book Entry Template

Blank Receipt Book Template Free Download

Cashbook & Bank Reconciliation Template

Cash Book Format in Excel

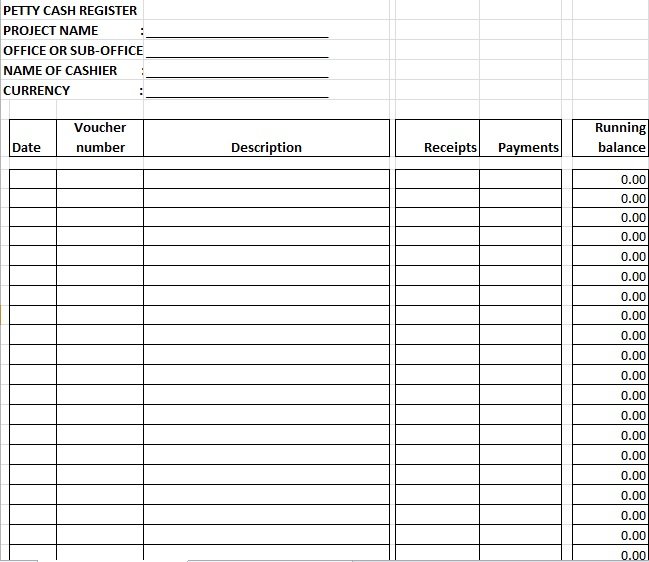

Petty Cash Book Format in Excel

How to fill out the cash book template?

Let us discuss step-by-step how to fill out this document;

- In the header of the document, enter the name of your company.

- Next, make the first entry for the time and note the current date if you start the cash book on the same day. Enter the end date if you fill out the cash book sheet over multiple days.

- Transferring the current cash balance into the table is the next step. You can find it in the first row as the ‘Balance’. The current date and bash amount are included in this section.

- In the next section, specify the following details;

1- The cash payments of the day (enter them chronologically)

2- The document number of the cash receipt

3- The date of the transaction

4- The amount of the income or expenditure - Enter short details of the business transaction in the ‘Comments’ column.

- After that, enter the sum of incomes and expenditures and calculate the balance. You should ensure that all values are correctly entered before printing out the cash book. This way, you can calculate the final entry without errors.

- At the end of every day, you should print out the cash book. Affix your signatures on the printed document. Don’t forget to file it chronologically with your other records.

- With the saved template, start a new cash book the next day.

FAQ’s

The accountant in a business firm prepares a cash book.

The main purpose of a cash book is to record all the cash transactions accurately as they occur.

In the cash book, the LF stands for the ledger folio number. Folios refer to reference numbers that divide books into various parts.

![Letter of Authorization from property Owner [Word, PDF]](https://exceltmp.com/wp-content/uploads/2021/08/registered-property-owner-authorization-letter-150x150.jpg)